Double declining method formula

When using the double-declining balance method be sure to use the following formula to make your calculations. 132 DDBA2A3A41212 First months.

Double Declining Balance Method Of Depreciation Accounting Corner

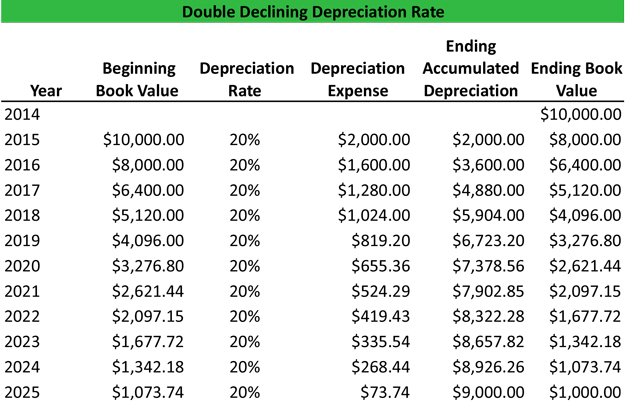

Double declining balance rate 2 x 20 40 The book value of the vehicle at the beginning of 2010 is 50 00000 The depreciation for the first year in 2010 is therefore.

. Double-declining Depreciation Rate Straight-line Depreciation Rate x 2. 50 000 x 40. For example if the straight-line depreciation rate is 10 and the book value of the asset is 45000 you would calculate the new DDB depreciation rate as such.

Double Declining Balance Method formula 2. Use the following formula to calculate double-declining depreciation rate. The double declining balance formula.

Heres the formula for calculating the amount to be. DDB depreciation formula The DDB depreciation method is a little more complicated than the straight-line method. Double Declining Balance Method formula 2 Book Value of.

While the total expense remains the same over the. Formula for Double Declining Balance Method. Result DDBA2A3A43651 First days depreciation using double-declining balance method.

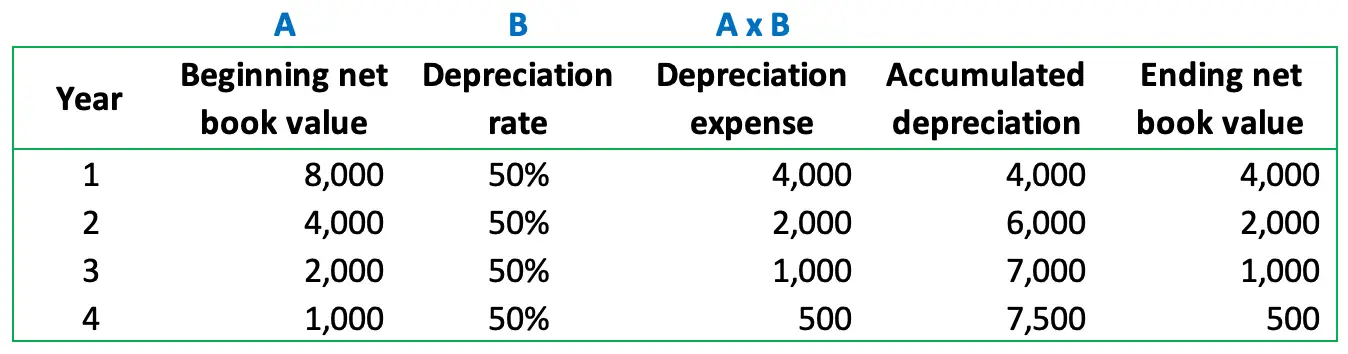

Depreciation 2 Straight-line depreciation percent. Double declining balance is calculated using this formula. Calculating a double declining balance is not complex although it.

2 x 10 20 x. In other words the depreciation rate in the double-declining balance depreciation method equals the straight-line rate multiplying by two. Default factor is 2.

2 x basic depreciation rate x book value. The term double in the double-declining balance depreciation comes from the determining of deprecation rate to be twice of the straight-line rate. The double declining balance is.

In other words the depreciation rate in the. The Double Declining method calculates depreciation by multiplying the asset book value at the beginning of the fiscal year by basic depreciation rate and 2. Cost required argument This is the initial.

The formula for depreciation under the double-declining method is as follows.

Double Declining Balance Depreciation Calculator

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

Depreciation Expense Calculator Cheap Sale 55 Off Www Ingeniovirtual Com

Double Declining Balance Depreciation Daily Business

Solved The Double Declining Balance Formula In Accounting Is Chegg Com

Calculate Double Declining Balance Depreciation Accountinginside

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Depreciation Efinancemanagement

Double Declining Balance Method Of Deprecitiation Formula Examples

Depreciation Formula Examples With Excel Template

How To Use The Excel Ddb Function Exceljet

Depreciation Formula Examples With Excel Template

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

What Is The Double Declining Balance Method Definition Meaning Example

Depreciation Formula Calculate Depreciation Expense

Simple Tutorial Double Declining Balance Method Youtube